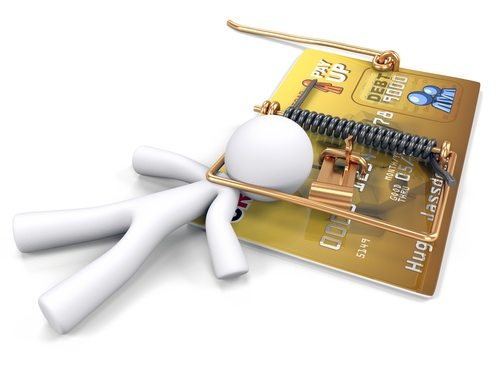

Is your credit card interest piling up? Here’s how you can avoid it.

A credit card is a facility which can be used based on convenience, but it can also become a financial burden if not handled properly. High credit card interest is a bane that most people suffer because they have not learnt how to use it effectively and without burden. Here are a few ways you can avoid interest or default on credit cards.

1. Do not avail special services – There are many companies which offer value adds, such as protection against credit card fraud and life insurance. Such services are typically not essential and are also overpriced.

2. Use credit cards only for emergencies – Make sure that you use credit cards during emergencies, as your daily expense on these cards can pull you down with debt when really needed. In order to steer clear of debt, you can create a plan to pay it off easily.

3. Pay on time – Give priority to credit card bills so that you escape the late paying charges. Paying late can increase the interest to the default rate as per the card agreement.

4. Do not have too many credit cards – Get rid of multiple credit cards and only depend on one or two, as it can become difficult to keep a track of the transactions that you have made.

5. Keep track of purchases – Pay attention to your credit card bills as there might be some transactions which have been made without your knowledge or could be a result of a credit card fraud.

Photo Credits: creditkarma